philadelphia property tax rate 2022

Property tax in philadelphia county is calculated by multiplying the taxable value with the corresponding tax rates and is an estimate of what an owner not benefiting from tax exemptions would pay. Only property owners whose values change will receive notifications.

An office building worth 50 million has the same 13998 property tax rate as a home worth 50000.

. Different rates for various types of property. Pennsylvania is ranked 1120th of the 3143 counties in the United States in order of the median amount of property. An office building worth 50 million has the same 13998 property tax rate as a home worth 50000.

There is a general property tax rate of 13998 for the whole county comprised of 06317 allocated to the city and 07681 allocated to schools. Tax Year 2022 assessments will be certified by OPA by March 31 2021. The surge to about double the number reviewed by the panel most years came as developers raced to take full advantage of the citys 10-year property tax abatement for new construction officials said.

The City of Philadelphia has announced that due to operational concerns caused by the COVID-19 pandemic it will forego a citywide reassessment of all property values for tax year 2022. This figure corroborates Zillows positive forecast. Philadelphia County collects on average 091 of a propertys assessed fair market value as property tax.

Thats down more than six. This amounts to an annual real estate appreciation of nearly 499 which puts Philadelphia in the top 30 nationally for real estate appreciation. But you must act fast as March 31 is also the deadline to apply for the 2022 Real Estate Installment Plan.

06317 City 07681 School District 13998 Total. Staying the course for Tax Year 2022 will allow staff more time to ready the CAMA system fully to produce a reassessment for Tax Year 2023 rather than diverting resources to short-term fixes. The City of Philadelphia and the School District of Philadelphia both impose a tax on all real estate in the CityFor the 2022 tax year the rates are.

Whether you are already a resident or just considering moving to Philadelphia to live or invest in real estate estimate local property tax rates and learn how real estate tax works. The last citywide reassessment was for tax year 2020 based on values the Office of Property Assessment certified on or before March 31 2019. 2022 Tax Rates Interboro 33 PROSPECT PARK 2999 557 245085 330775 1 Borough WallingfordSwarthmore 34 PROVIDENCE NETHER 2999 32058 CALL SD.

That long-established interpretation limits city officials policy options and helps explain several distinctive features of Philadelphias tax system. 1 the city began phasing out the abatement by reducing its value by 10 a year. There is also a homestead exemption of 45000 which is subtracted from the homes market value before calculating the tax.

The City of Philadelphia and the School District of Philadelphia both impose a tax on all real estate in the City. For the 2021 tax year the rates are. Different rates for various types of property though commonplace elsewhere are prohibited.

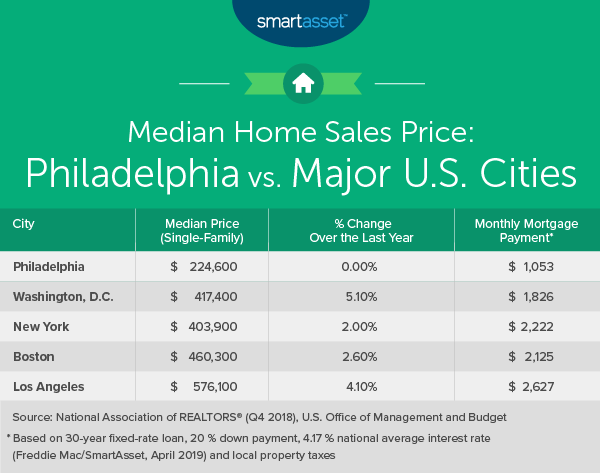

Houses 2 days ago Philadelphia PA 19105Our Installment program is also helping seniors and low-income families pay their bills in monthly installments. According to Zillow Philadelphia real estate market prices increased by about 11 in the last year and it estimates that prices will rise again in 2022. Pay your 2022 property tax by March 31 Department of.

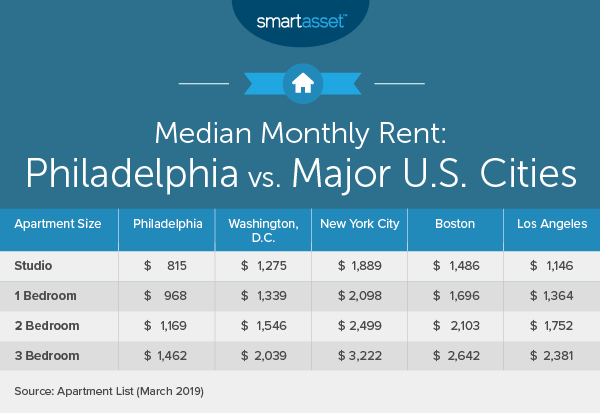

According to data from RENTCafé 45 percent of the citys housing units are renter-occupied and 54 percent are owner-occupied. For the 2022 tax year the rates are. In the latest quarter the appreciation rate has been 352 which annualizes to a rate of nearly 1483.

1 percent of the value of real estate including contracted-for improvements to property transferred by deed instrument long-term lease or other writing. Tax rates cant be raised before informing the public. Property tax in Philadelphia County is calculated by multiplying the taxable value with the corresponding tax rates and is an estimate of what an owner not benefiting from tax exemptions would pay.

62048 Township Rose Tree Media 35 PROVIDENCE UPPER 2999 2257 141643 194203 Township Radnor 36 RADNOR 2999 22837 139224 192051 Township Ridley 37 RIDLEY PARK 2999 525 236840. The median property tax in Philadelphia County Pennsylvania is 1236 per year for a home worth the median value of 135200. Philadelphia Property Tax Rate The Philadelphia property tax rate is 139998 of the propertys assessed market value.

Real Estate Tax Services City of Philadelphia. Learn all about Philadelphia real estate tax. Policy options and helps explain several distinctive features of Philadelphias tax system.

06317 City 07681 School District 13998 Total philadelphia real estate tax department Verified 8 days ago Url. Philadelphias appreciation rates remain among the highest in the country including the larger metropolitan area where the months worth of supply has fallen to 11 months. Then a public hearing has to be held to discuss the proposal.

PA Sales Use and Hotel Occupancy Tax 6 percent. If Philadelphia property taxes have been too high for your budget causing delinquent property tax payments consider taking a quick property tax loan from lenders in Philadelphia NY to save your home from a potential foreclosure. The fiscal year 2020 budget does not contain any changes to the tax rate so the same tax rate as 2019 will be used to calculate.

Cost Of Living In Philadelphia Pa 2022 Movingwaldo

Philadelphia On Track For Record Construction Activity In 2022 Philadelphia Yimby

Moving In Philadelphia Guide To Philadelphia Neighborhoods

The Cost Of Living In Philadelphia Smartasset

Safest Neighborhoods In Philadelphia 2022 Top 6 Safe Philadelphia Neighborhoods

Pittsburgh Vs Philadelphia 2022 Comparison Pros Cons Which City Is Better

How Much Does It Cost To Build A House In Philadelphia Home Builder Digest

Philadelphia Wage And Earnings Taxes Decrease On July 1 Department Of Revenue City Of Philadelphia

Socked By The Pandemic Kenney Administration Forgoes Property Reassessments For Second Year In A Row Pennsylvania Capital Star

The Cost Of Living In Philadelphia Smartasset

Northeast Philadelphia Neighborhood Guide

Handle With Care 2022 Property Tax Bills Department Of Revenue City Of Philadelphia

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

Does Philadelphia Tax Retirement Income Tax Exemption

Philly Real Estate Analyst S Predictions For 2022 Whyy

Handle With Care 2022 Property Tax Bills Department Of Revenue City Of Philadelphia